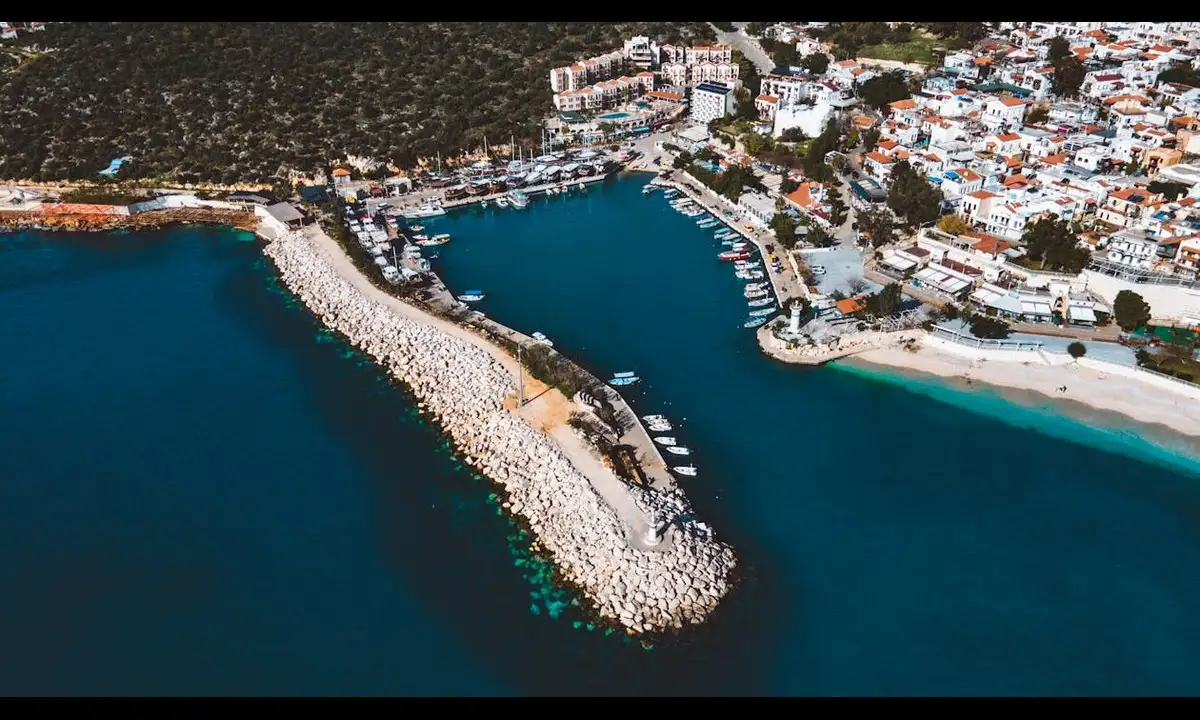

Kalkan, located on the stunning Turquoise Coast of Turkey, has been remarkably pursued by property buyers both locally and internationally. Due to its incredible views of the sea, heaps of luxury villas, and a calm ambiance, Kalkan is ideal for those people who want a quiet high-class living. On the contrary, if you wish to buy a property in Kalkan, you will need to consider one of the cost aspects; property tax.

In this section, this blog focuses on understanding different major property taxation that exist in Kalkan where property owners have tax obligations. We will focus on rates, processes of payment of the taxes, and relationships between the kinds of taxes and the properties on which they apply. Furthermore, other associated expenses that property purchasers can incur while purchasing a property in this beautiful seaside town will be shared as well.

About Property Tax in Kalkan

Like the rest of Turkey, property tax in Kalkan is set by the Turkish government and depends on many factors such as the kind of property, where it is situated, and the market value. The percentage of the tax rate on real estate in Turkey is usually in the range of 0.1% to 0.6% of the value assessed of the property.

Properties in Kalkan, situated in the Kas district of Antalya province, generally have similar rates to those in coastal towns. It should be understood that the appreciation of the Kalkan region or the factors influencing tourism trends in this area, raises the prices of the properties, which can affect the tax amount.

Property Tax Rates in Kalkan

The property tax system in Turkey is a progressive form of taxation, hence the tax paid is based on the type of property owned by the individual. Below are the standard property tax rates applicable to Kalkan:

Residential properties

The property tax rate applicable to residential properties in Kalkan is on average 0.2 % of the cost of the house. This is in agreement with the property taxation ratios prevailing in the rest of metropolitan cities in Turkey which Kalkan falls under as per its provincial classification.

Commercial properties

Within the boundaries of Kalkan Council, Commercial properties attract a higher tax at the rate of 0.4%. This includes shops, offices, and other business-related establishments in Kalkan.

Land

The tax for undeveloped or vacant land in Kalkan is 0.6%, which makes it the most expensive among property types. This is because still undeveloped land may have a prospecting value, especially in a place like Kalkan.

Kalkan Property Taxes: How They Work, and When to Pay Them

In Kalkan, property tax is paid every year, either in once or twice during the year in equal installments. The payments are made in two specific periods that fall in May and November. noncompliance with property tax payments by the due date may attract late payment fees and accrual of penalties and therefore it’s important to try and observe these dates.

Property owners can either pay their taxes at the local municipal office in Kas or use the different online platforms that have been put in place for tax payments.

Why It Is Important Not to Let Your Guard Down

Property tax relating to Kalkan tends to be quite simple however it is advisable to keep on the lookout for any new laws that may alter your commitments. Local and national taxation levels differ and therefore it's good to see a tax advisor or even your property agent to be sure that you have the latest information.

Conclusion:

Kalkan is undoubtedly one of the best locations to buy a property as it affords a very high standard of living in one of the best coastal location towns in Turkey. Nonetheless, just like anywhere, the ownership of a property in Kalkan does not mean that one is scot-free and would come with costs related to property taxes. When considering property investments, it's advisable to take into account these expenses since residential property tax rates are at 0.2% on average while higher rates apply for commercial and land properties.

You can have the advantage of owning property in Kalkan and still meet your financial obligations if you keep abreast and pay on time. With this, if you want to build or buy a holiday villa, wish to rent out an apartment, or purchase a plot of land in Kalkan, then how easy it is to understand how much the property tax in Kalkan is a determining factor.